A warming Arctic brings opportunity and risk

By Cmdr. Rachael Gosnell, U.S. Navy, Marshall Center professor

The unprecedented warming of the Arctic is heightening interest in the region’s tremendous natural resources. As the global requirement for energy — and energy security — surges, many are looking northward to fulfill the demand.

There is no doubt that the energy resource potential of the Arctic is immense. The 2008 U.S. Geological Survey’s Circum-Arctic Resource Appraisal (still considered the most accurate assessment of regional oil and gas reserves) estimates the Arctic holds more than 90 billion barrels of oil, 1,669 trillion cubic feet of natural gas and 44 billion barrels of liquid natural gas. This accounts for nearly one-third of the world’s estimated conventional natural-gas supply and 13% of estimated global oil reserves. If developed, Arctic oil and gas could provide significant energy security for stakeholders, with a net worth estimated to be hundreds of billions of dollars.

The region further holds increasing allure as a maritime transit corridor, bringing valuable hydrocarbons to market. Moreover, fossil fuels are not the only energy resource of the region. The Arctic offers a plethora of sustainable energy as well, including hydropower, geothermal, solar, ocean and wind energies. Policymakers have begun to look northward, given the appeal of enhancing energy security through Arctic resources.

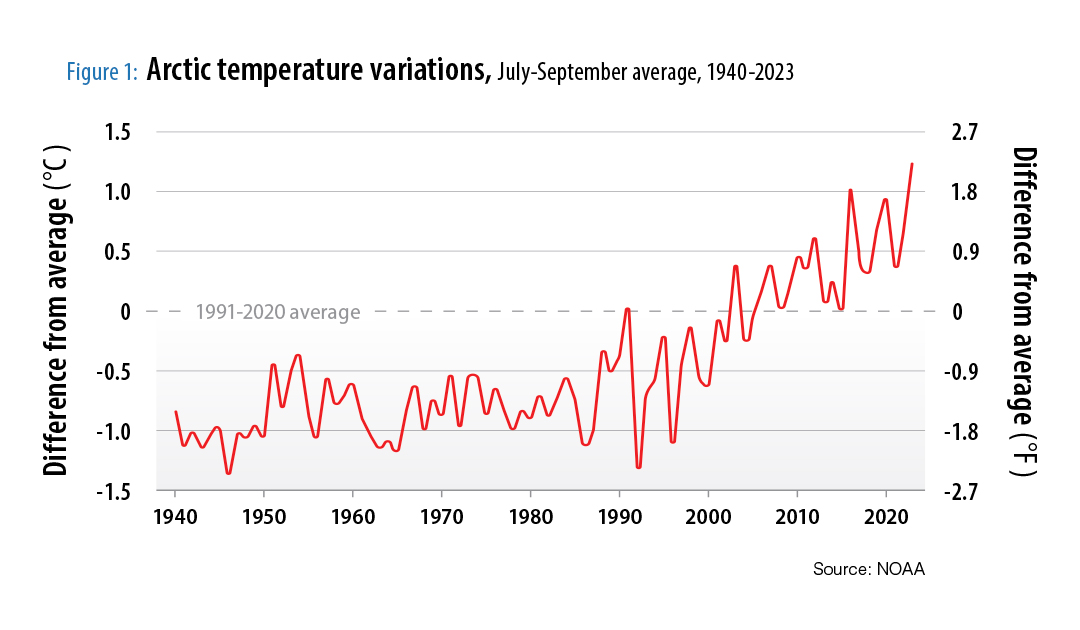

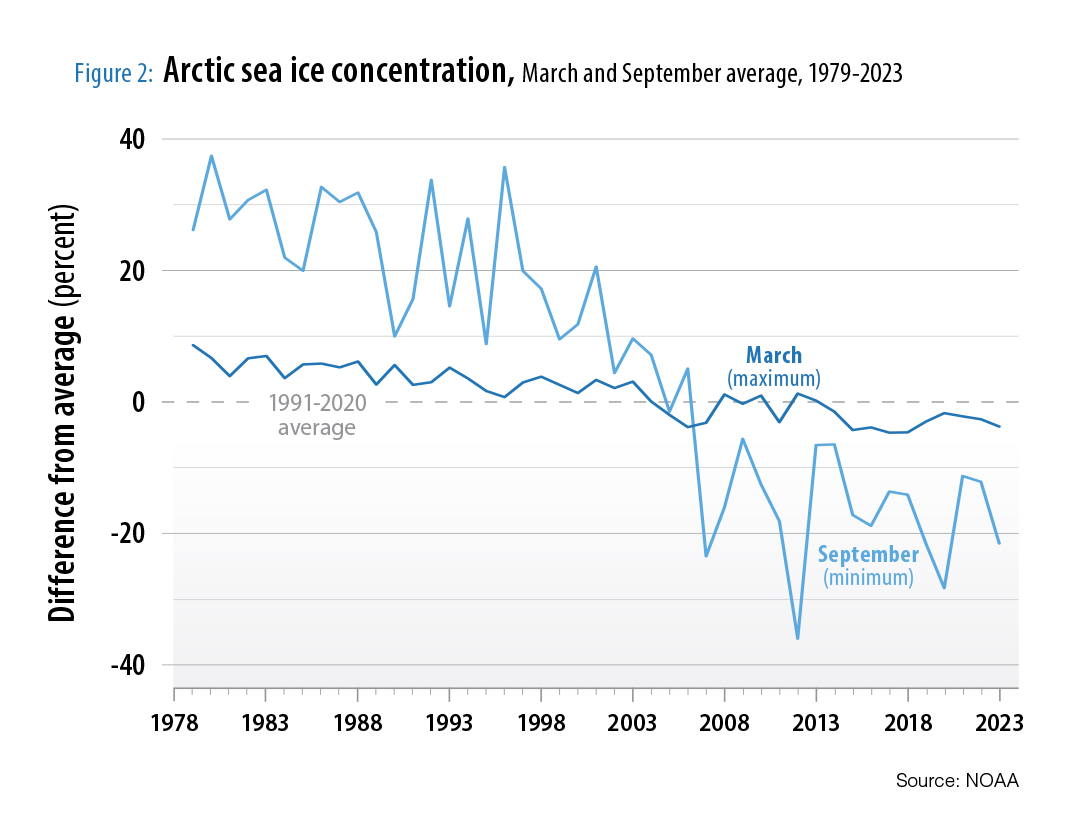

Yet the vast potential of Arctic energy also brings immense challenges in developing and utilizing the resources. Paradoxically, while the region holds sizable fossil fuel resources, it is also deeply affected by climate change, which is amplified by human activities, particularly the burning of fossil fuels. Warming at a rate of up to four times the global average, the region faces serious threats to its fragile ecosystem. According to the U.S. National Oceanic and Atmospheric Administration’s (NOAA) Arctic Report Card 2023, the Arctic is “increasingly warmer, less frozen, and wetter, with regional extremes in weather, climate patterns, and ecosystem responses” due to climate trends.

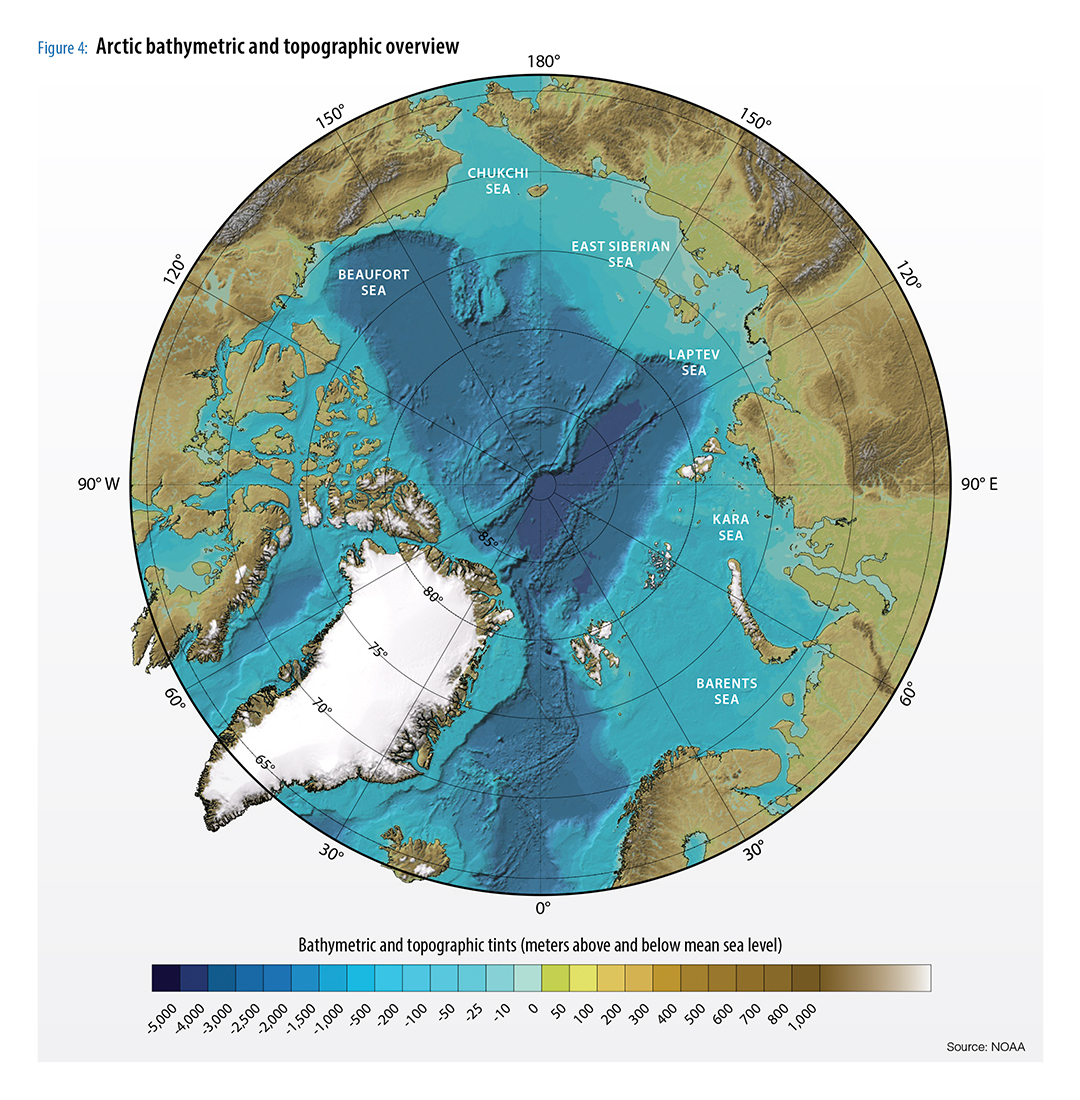

To better understand the energy security potential of an increasingly warm Arctic, it is critical to first understand the complexities of the region. Even defining the Arctic can be challenging. There are more than a dozen definitions based upon environmental, human, geographic and geopolitical factors. While definitions vary, the most commonly accepted one is the region north of the Arctic Circle (66.5 degrees north), or the latitude above which the sun does not set during the summer solstice or rise during the winter solstice. The Arctic Ocean, while it is the smallest and shallowest of the world’s oceans, is still more than five times the size of the Mediterranean Sea, encompassing about 14.09 million square kilometers. Arctic exploration dates back to the earliest Indigenous people, who settled the region as early as 20,000 years ago.

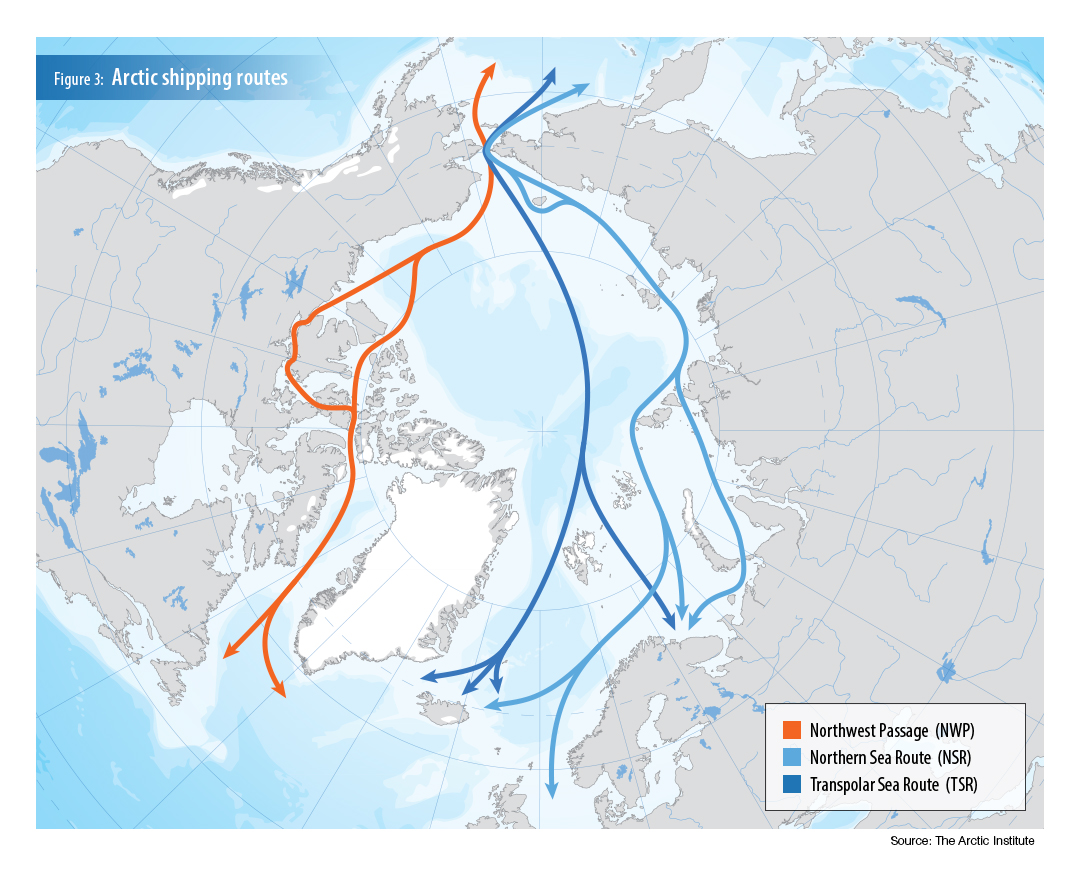

The Arctic is crucially strategic. During the Cold War, the predominant focus on the region centered on its airspace, which was the fastest route for strategic bombers or intercontinental ballistic missiles to traverse between the Soviet Union and the United States, or vice versa. However, the undersea domain was also quite active, given the attraction of hiding nuclear-powered ballistic missile submarines that assured second-strike capabilities under the ice. While natural resources have long been exploited in the region, moving those resources to market can be difficult. The potential for a northern maritime corridor connecting Europe with Asia has long held allure — and with good reason. The Arctic Ocean holds the potential to connect the Atlantic and Pacific oceans, uniting more than 80% of the global population and connecting global trade centers. With the unprecedented warming trends, the Arctic is evolving in many ways.

Although the Arctic will be affected greatly by climate change; it will continue to be a hostile environment. The North Pole, for example, still averages minus 40 degrees Celsius in winter. Though unquestionably cold, the North Pole is moderated by ocean water. The record low temperature for the Northern Hemisphere — minus 69.6 degrees Celsius — was observed on the Greenland Ice Sheet in 1991, according to the World Meteorological Organization. Russia’s Far East routinely experiences temperatures that approach this record. The North American Arctic also experiences extreme cold, while temperatures in the Scandinavian Arctic tend to be more moderated by the jet stream. Though warmer, temperatures still routinely linger well below freezing and pose challenging conditions in which to live and work. Indeed, it must be understood that each Arctic subregion —

the European High North, North American Arctic and Russian Arctic — has unique geographic, hydrographic and climate characteristics that in turn drive the subregion’s economic development, population and governmental approach.

The extreme cold notable across the entire Arctic region not only affects survivability but also the functionality of infrastructure and equipment. The Arctic cold is accompanied by frequent storms, ice and a long, dark winter. The melting of ice due to warming trends may worsen the region’s weather with an increase in the frequency and severity of storms. These conditions have long limited the establishment of infrastructure in the High North and will continue to do so. Indeed, the regional population hovers near 4 million and is projected to only increase about 4% by 2030, compared with a projected 29% global population increase. The Russian Arctic holds about half of the regional population, which can be explained in part by Soviet policies to populate the region. In “Russia’s Arctic Strategy through 2035: Grand Plans and Pragmatic Constraints,” for the German Institute for International and Security Affairs, Janis Kluge and Michael Paul report that the Russian Arctic has seen a net outward migration of about 18,000 annually since the collapse of the Soviet Union. The pan-Arctic region — though home to many Indigenous communities — is notorious for challenging environmental conditions, poor infrastructure, lack of medical and educational support, gender imbalance and high cost of living.

An opening maritime corridor

The Arctic has proved challenging to the many who have sought to explore and develop the region, but melting ice trends have again raised interest in a maritime corridor. The existence of a maritime route connecting the Atlantic and Pacific oceans was first surmised to exist in 1525. Russian Czar Peter the Great sponsored numerous expeditions to find this route, though it was not until the 1930s that the Soviet Union officially opened the Northern Sea Route (NSR). This route was originally conceived to resupply northern communities that were virtually inaccessible by other means, rather than to serve as a transit corridor.

Current warming trends are piquing interest in the potential for the three northern maritime routes — the NSR along the Russian coastline, the Northwest Passage (NWP) along the Canadian coastline and the Transpolar Sea Route (TSR) through the Central Arctic Ocean. While the NSR and NWP have enabled limited maritime traffic for decades (and even longer if Indigenous travel is considered), both are increasingly being discussed as viable international transit corridors.

In 2011, Vladimir Putin, then Russia’s prime minister, noted at the Arctic Forum that the “shortest routes between Europe’s largest markets and the Asia-Pacific region lie across the Arctic.” Many have seized on the distance to highlight the potential of the Arctic as a shipping corridor. The shipping route from East Asia to Northern Europe is about 11,200 nautical miles through the Suez Canal, but only about 6,500 nautical miles through the Arctic. This difference can decrease transit times by 12 to 15 days if weather conditions are good, though relatively few ships have opted to head north. In 2023, just 75 vessels with 2.1 million metric tons of cargo transited the NSR, compared with more than 23,000 vessels and more than 1.5 billion tons of cargo through the Suez Canal, according to the Northern Sea Route Administration and the Suez Canal Authority.

The commercial maritime industry’s reluctance to use the NSR is largely due to risks associated with the lack of regional infrastructure — including accurate nautical charts and ports for resupply and maintenance — as well as extreme weather, challenging ice, a fragile ecosystem and a lack of reliable communications.

The inability to accurately predict transit routes and weather that can often cause delays of days or even weeks is potentially disastrous for an industry that utilizes a just-in-time supply model. The requirement for shippers to adhere to the International Maritime Organization’s Polar Code for vessels in the Arctic, combined with high insurance rates and operating costs, continues to make Arctic transit a tenuous proposition for the commercial shipping industry until more infrastructure is established in the region.

Further, the vessels passing through the NSR and NWP are limited in size due to the draft limitations of those routes, meaning industry cannot take advantage of economies of scale with the newest bulk cargo vessels. Only the as-yet inaccessible TSR presents the deep-water option necessary for the workhorses of the world’s shipping fleet — the deep-drafted very large and ultralarge crude carriers of more than 200,000 deadweight tonnage (such as the Aframax and Suezmax oil tankers) used on the main trade routes between the Persian Gulf and Europe, North America and Asia, and between Africa and China. The largest ships, such as the container ship Ever Given (infamous for getting stuck in the Suez Canal), exceed the length of a U.S. aircraft carrier and have a draft of 14.5 meters. The Bering Strait poses some concerns, with a depth ranging from 30 to 50 meters. Even with the TSR expected to open for a limited window in the summer by midcentury, challenges will continue to plague all three Arctic routes.

Despite these limitations, the Arctic is seeing more regional activity — particularly such that enables the extraction and production of natural resources, and their shipment to markets. Vessel traffic on the NSR is approaching record levels as ships bring construction supplies for new energy projects in the Russian Arctic or deliver natural resources to market. A record 35 million tons shipped on the NSR in 2023, with the majority being liquefied natural gas (LNG) sent to market, in addition to 1.5 million tons of crude oil shipped from the Baltic Sea through the Arctic to Chinese markets. Activity stemming from construction of Arctic energy projects and shipping of natural resources will continue to rise. However, the attraction of shorter maritime routes often lacks a thorough understanding of the nuances of operating in the region.

Opportunities … and challenges

While a simplistic argument portends that warming temperatures driven by climate change will melt ice and enable greater regional activity onshore and offshore, the reality is far more complicated. Rising temperatures are indeed melting ice but also accelerating coastal erosion and permafrost thaw, and increasing the unpredictability of weather patterns that will affect operations at sea and ashore. Significant amounts of regional infrastructure — buildings, roads, pipelines, railroads and airports — are being damaged or destroyed by permafrost thaw. Nearly 70% of infrastructure in the Russian Arctic is vulnerable to these devastating effects. In 2021, Alexander Kozlov, the Russian minister for natural resources, highlighted the challenges of climate change on Russian Arctic infrastructure. He noted that 40% of buildings show signs of buckling and up to 29% of oil and gas production facilities can no longer be operated.

Low population density and insufficient infrastructure result in further challenges for development and extraction of natural resources. Indeed, the discontinuous electric grid infrastructure, designed for a small, dispersed population, further complicates local power generation.

Therein lies another Arctic paradox. While the region may provide an answer to global energy security demands, the roughly 4 million Arctic residents will continue to face high energy prices, insufficient and disconnected power grids, and disruption to local communities unless more attention is given to implementing sustainable development practices that are mindful of the fragility of the ecosystem and local communities. Energy exploration, development and extraction in the Arctic is significantly more expensive and more challenging than projects of similar scale in warmer climates.

Yet, with rising global interest in the abundant energy resources of the north, there is no shortage of prospective stakeholders extending beyond the eight Arctic states (Canada, Denmark, Finland, Iceland, Norway, Russia, Sweden and the U.S.) to include China, Japan and South Korea, as well as the European Union. As world energy demands surge, nations are scrambling to locate new sources to power the future. The Arctic holds such resources, but their development will present challenges given the hazards of extraction in an inhospitable climate.

Russia’s energy strategy

Prior to being hit with Western sanctions for the unprovoked invasion of Ukraine, Russia aimed to boost its Arctic production of LNG to nearly 100 million tons a year — or roughly 20% of the global market, Arctic Institute founder Malte Humpert reported in March 2024 for High North News. Yet, it is clear that the Arctic is no longer — if it ever was — immune to global geopolitics. The war in Ukraine has halted cooperation between the West and Russia in the Arctic, ending the era of so-called Arctic exceptionalism. The Arctic energy business, brimming with potential and challenges, will be increasingly reflective of global geopolitics.

The Arctic will continue to fuel the Russian energy export market. The region currently accounts for roughly 90% of Russia’s natural gas and 17% of its oil production. Before 2022, this translated into an estimated 20% of Russian gross domestic product, and 22% of its total exports originated in the Russian Arctic Zone, according to a 2017 paper for the Wilson Center. Current data is unavailable but likely to reflect previous trends. Yet, Moscow demands resources to sustain its war machine in Ukraine, which means shifting them away from fulfilling the economic and societal development goals of its Arctic strategy. Indeed, the lack of sufficient state funding for Arctic developmental goals has translated into the Russian energy sector being the key driver of new projects. These projects nearly always require local infrastructure upgrades to support the extraction, development and production of natural resources, as well as the transit of those resources to foreign markets.

The most significant Russian energy project in the Arctic, Yamal LNG, began commercial operations in December 2017. The project is serviced by a specially designed fleet of 15 Christophe de Margerie-class Arc7-rated icebreaking LNG carriers that have delivered about 1,250 shipments to Asia and Europe since 2017. A cooperative project between Aker Arctic Technology, Daewoo Shipbuilding and Marine Engineering, and Yamal LNG, the vessels are specially designed to service the Sabetta terminal, operating independently on the NSR during the summer and fall. Year-round navigation in the Arctic is made possible with icebreaker support, but transit times for the treacherous ice-covered Eastern route to Asia are much longer in winter. Experimental voyages have generally taken a month or longer, despite being escorted by powerful Russian nuclear icebreakers, making the westward route to either Murmansk or European ports preferable in winter.

Arctic LNG 2 is another Novatek-led, integrated natural gas production, liquefaction and shipping project under development, with an anticipated capacity of 19.8 million metric tons per year of LNG and 1.6 million tons per year of stable gas condensate. Planned as Russia’s largest LNG plant, the project has been delayed by Western sanctions and the recent decision by China’s Wison New Energies to discontinue work. Further, the specially designed icebreaking LNG carriers are facing delays after Western sanctions hit the shipyards building the fleet.

About 85% of Russian LNG production was originally intended for Europe — predominantly for transshipment to Belgium and France, according to Humpert. While the program was designed to sell LNG to both Asia and Europe, negative reactions to the invasion of Ukraine have forced Russia to look east. The Asian market has always enticed Moscow. In fact, the first shipment of LNG from the Sabetta terminal, loaded onto the Christophe de Margerie in December 2017 under Putin’s eye, sailed to China.

Initially, sanctions targeting the Russian LNG industry — or the icebreaker tankers that bring the bulk of the resource to market — were limited. In 2023, European nations received more than 8 billion euros’ worth of Russian LNG originating at the Sabetta terminal. Sanctions targeting LNG production facilities, the production of ice-class LNG tankers and Russian LNG markets will undoubtedly affect Moscow’s grander plans to introduce more Arctic resources — particularly natural gas from the Yamal and Gyda peninsulas — into the global energy market.

Thus far, the withdrawal of Western investment and technology has largely been made up for by Chinese companies. But the loss of Western markets will be challenging to overcome. Importantly, the loss of Western European ports to offload LNG will be costly. The icebreakers are generally more expensive to operate than standard LNG tankers, as sailing these vessels — optimized to operate in polar waters — in temperate waters incurs further costs. But perhaps most importantly, longer voyages to market will affect the amount of LNG departing from Sabetta. Currently, the ice-class LNG carriers transport more than 90% of Yamal LNG’s production (some tankers with lower or no ice-class rating can operate in ice-free months). Longer transits to market mean a longer turnaround time to reload, which could ultimately lower productivity.

Indeed, this question already is surfacing for LNG projects under construction. With the 15 Christophe de Margerie tankers already committed to Yamal LNG, the next project to come online, Arctic LNG 2, will require 21 additional Arc7-rated ships. While four such vessels are close to completion, the remainder are entangled in Western sanctions. It is unlikely that South Korean shipyards will complete the fleet — and it is equally unlikely that Western technology incorporated into the design will be easily replaced while maintaining the same standards of efficiency and adherence to environmental regulations. An inability to ship product to market raises questions about the viability of Arctic LNG 2. Indeed, U.S. Assistant Secretary for Energy Resources Geoffrey Pyatt announced in November 2023 that the “objective is to kill that project” with sanctions. It remains to be seen if China will again step in to provide alternatives to sustain this project or any other Russian Arctic energy projects envisioned.

While Russia will continue to monetize its Arctic energy resources, the impact of Western sanctions will take a toll. Russia’s path in Ukraine could well determine the viability of its desire to fully exploit its northern energy resources. Meanwhile, turning to China as a substitute for Western investment, technology and markets may have far-reaching strategic implications.

America’s Arctic energy bust?

Despite Russia’s lead in oil and gas exploitation in the Arctic — and the potential for immense energy resources — Western oil companies are reluctant to move ahead with projects in the American Arctic. Estimates from the U.S. Geological Survey note that the Arctic National Wildlife Refuge (ANWR) holds nearly 12 billion barrels of oil, or 27% of proven U.S. oil reserves. Yet the reaction to development opportunities has been remarkably cold. There are several explanations for this. First, the uncertain regulatory environment has dampened enthusiasm for Arctic resource development, particularly in ANWR.

But even with government support, the costs are high. Due to the harsh conditions, remote distances, lack of a resident workforce and absence of infrastructure, exploration, development and production of energy in the region is very expensive, particularly when compared with more accessible regions, such as the Gulf of Mexico or shale opportunities ashore. Oil companies must contend with moving exploration, development and production equipment, and workers to remote regions that experience extreme cold, limited sunlight and harsh weather. Limited summer thawing and daylight offer a small window of opportunity to achieve key development and construction milestones. Furthermore, there are reduced operating efficiencies for Arctic production because of the challenges associated with remote, isolated areas, as well as the difficulties of moving the resources to market via more expensive means, such as shipping or pipelines. When permafrost thaws, roads and pipelines are affected by instability and even collapse. As in the Russian Arctic, permafrost thaw will continue to pose threats even to existing oil and gas infrastructure, requiring higher operation and maintenance costs.

Energy companies must also contend with risks to the environment in the event of an oil spill. Indeed, the break-even point for developing oil in the Alaskan Arctic is likely around $80 per barrel, although some estimates put the figure closer to $100 per barrel for offshore production. Compared with the break-even price for the Gulf of Mexico, which hovers at just over $30 per barrel, according to Rystad Energy’s modeling, the prospect of Arctic production is not a sound investment — even if the project could attain financing.

Most major U.S. banks have further ruled out financing new oil exploration in the Arctic, citing environmental policies advocating for mitigating climate change, reported Joseph Guzman for The Hill website in 2020. Environmentalists have long opposed drilling in the Arctic due to the probable negative impact on the fragile ecosystem and Indigenous peoples.

Perhaps the most notable example of the lack of interest was Shell’s departure from exploration in the Chukchi Sea in 2015 after a failed attempt costing $7 billion. The lack of crude discoveries from its exploratory well, combined with high prices, environmental concerns and an unpredictable federal regulatory environment overwhelmed the potential benefits. Shell has not expressed an interest in returning. Indeed, the oil majors have largely steered clear of the Arctic because of these challenges. Energy data and modeling have shed doubt on the economic viability of production in ANWR and the broader U.S. Arctic.

The green revolution?

While much of the focus on Arctic resources is understandably on the vast reserves of fossil fuels, it is important to note the nascent movement toward developing the region’s ample renewable resources. European High North countries have been leading in the development of green energy. Iceland is a world leader in developing renewable energy resources, relying on geothermal and hydroelectricity for nearly all of its energy requirements. For geothermal power, Iceland ranks in the top 10 nations globally, with a power generation capacity of 755 megawatts — or about 70% of its energy production.

Iceland is, of course, uniquely suited to harness geothermal energy, given that it has more than 200 volcanoes spread across an island inhabited by just under 400,000 residents. The abundant energy source has enabled Iceland to become well known for aluminum production, but also for data centers, which are attracted to the area’s low temperatures that naturally cool the facilities. The nation exports its geothermal expertise to global projects, making an even larger impact for a small nation.

Though a leader in renewable hydropower, Norway is itself an energy paradox. It is the seventh-largest natural gas producer in the world and also exports significant quantities of oil. Norway is a net energy exporter, with 87% of its energy production exported in 2020, allowing the nation to play a stabilizing role in global oil and gas supply — particularly as it helped to meet European energy needs after Russia’s invasion of Ukraine. But the nation also has an extensive focus on renewables in order to transition to a cleaner energy model. In particular, hydropower resources make up more than 90% of its electricity generation.

Indeed, Norway is proving to be a model in the green transition. Other Arctic states are also pursuing green energy policies. Notably, Greenland is seeking to transition from a dependency on fossil fuels — and high import costs — to an entirely renewable energy system in the coming decades. The autonomous island, with a population of barely 56,000, is seeking to optimize its use of solar and wind energy. Hydropower already accounts for more than 80% of the island’s electricity production.

The development of renewable resources in the Arctic region may yield a climate-friendly opportunity to achieve both energy security and limit further effects of climate change in a region being dramatically affected by warming trends. But this requires political will and significant investment in these technologies. Better understanding of how to store energy in the Arctic — where solar energy, for example, can only be captured for part of the year — will be a critical enabler in the green transition.

Conclusion

When combining its green energy potential with its proven and predicted fossil fuel reserves, it is clear that the Arctic has the potential to become a global energy powerhouse. The Arctic undoubtedly possesses trillions of dollars’ worth of natural resources. Yet, the concerns of a resource curse are valid in a region long known for the inhumane treatment of Indigenous communities. The development of natural resources will deeply affect Indigenous and other communities alike. Perhaps a harbinger of potential conflict, the Norwegian Supreme Court ruled in 2021 that two wind farms built in Fosen violated Sami rights and disrupted traditional reindeer grazing lands. The Norwegian government apologized in early March 2024, and a deal was finally reached after three years of ambiguity that pitted Europe’s largest onshore wind farm against the local Sami community, which has rights guaranteed under the United Nations. The agreement permits the partially state-owned wind farm to remain in operation, while providing compensation to the Sami with a share of the energy production, a monetary grant to strengthen Sami culture and a new area for grazing.

The Norway case highlights the challenges faced by Indigenous communities — and by governments seeking to accelerate energy production. This adds another layer of complexity to the already significant challenges posed by climate trends, weather challenges and a significant lack of infrastructure and people to support regional energy development. Though resources abound in the region, it is expensive and difficult to extract them. Movement to market adds an additional layer of difficulty, as onshore options such as pipelines or rail grapple with the devastating effects of permafrost thaw on regional infrastructure. At sea, vessels must contend with unpredictable sea ice, lack of hydrographic data, limited infrastructure (particularly deepwater ports and crisis response capabilities), and high operating costs due to insurance rates and tariffs through the NSR. Thus far, financiers have opted to steer away from risky investments in the North American Arctic due to the combination of high costs, uncertainty of reserves and potential for environmental damage. Yet, Russia has doubled down on production, largely due to economic necessity.

The development of energy resources remains fraught with challenges that must be overcome to truly provide energy security to a region that is notorious for an inhospitable climate, vast distances, poor infrastructure and an abundance of climate-related difficulties, such as permafrost thaw, coastal erosion and ice melt. The allure of Arctic energy will require significant investments to realize the potential while preserving the fragile environment.

The views presented here are Cmdr. Gosnell’s and do not necessarily reflect those of the Marshall Center, the U.S. Navy or the U.S. Department of Defense.

Comments are closed.