Lithuania’s liquefied natural gas terminal diversifies energy supplies in the Baltic states

By Dr. Arūnas Molis and Dr. Giedrius Česnakas

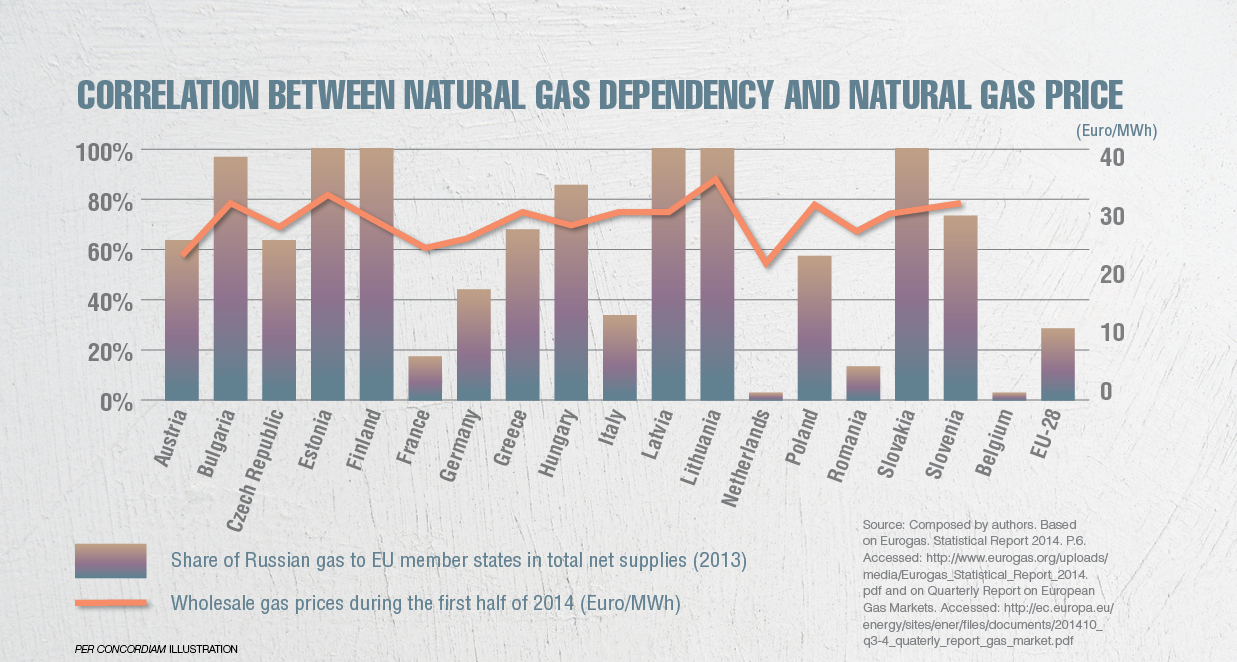

In 2014, six European Union member states — Bulgaria, Estonia, Finland, Lithuania, Latvia and Slovakia — were more than 90 percent dependent on Russian natural gas. Five of those countries were among the seven EU states paying the most for natural gas. Pricing is only one side of the coin — another is geopolitical pressure placed on dependent consumers. But after Russia cut gas supplies in 2009, priorities changed. The EU implemented its Third Energy Package, the Southern Gas Corridor initiative received political and financial attention from the EU, and an Energy Union ceased to be only a dream. Europe refocused on consumer needs and worked to diversify supplies. Increasing the use of renewables, improving coordination with suppliers and creating regional gas and electricity markets became political priorities. Consequently, the necessary energy infrastructure was developed at a speed not previously seen. Europe started preparing for gas supply disruptions.

In this context, expectations for liquefied natural gas (LNG) are high among both civilians and experts. It is hoped that establishing market-based conditions will trigger diversification of the gas supply, which would lower prices and make supplies more secure. In the long term, LNG infrastructure is expected to change gas sector rules of the game by allowing consumers to choose suppliers, which helps prevent energy from being used for political purposes. Trust, strong commitments, fair contracts and transparent prices are expected to guarantee win-win relations between consumer and supplier.

These expectations are quite logical. First, global trade of LNG has been rising since 2000: Only 142.95 billion cubic meters (bcm) of LNG were traded in 2001, but it grew to 325.3 bcm in 2013. Over the same period, European imports of LNG increased from 33.53 bcm to 51.5 bcm. By the end of 2014, 23 LNG terminals were operating in Europe, with five more under construction and 36 planned. LNG technologies proved able to bring global market forces into traditionally regional natural gas markets that had been dominated by regional suppliers.

These expectations are quite logical. First, global trade of LNG has been rising since 2000: Only 142.95 billion cubic meters (bcm) of LNG were traded in 2001, but it grew to 325.3 bcm in 2013. Over the same period, European imports of LNG increased from 33.53 bcm to 51.5 bcm. By the end of 2014, 23 LNG terminals were operating in Europe, with five more under construction and 36 planned. LNG technologies proved able to bring global market forces into traditionally regional natural gas markets that had been dominated by regional suppliers.

In Lithuania’s case, the expectations weren’t empty. Diversification of gas supplies allowed consumers to reduce price, keep one supplier from monopolizing the market and at least partially equalize the negotiating power of consumers and suppliers. Essentially, dependency is replaced by interdependency. Expanding market principles reduced the role of states and allowed the laws of economics to govern, further limiting the use of energy resources as tools of foreign policy.

Lithuania’s natural gas sector

Natural gas is strategically important for the nation. In 2015, it was the primary fuel for heat production in centralized, district heating systems — the main method of heating in Lithuania. It is also the primary fuel for domestic electricity production, especially after the Ignalina Nuclear Power Plant was closed in 2009. Additionally, the cost and supply of natural gas are extremely important to Lithuania’s energy intense industries. In this context, it is worth noting that Lithuania’s natural gas infrastructure was developed in the 1960s and 1980s with supply from Russia, via Belarus, and no supply alternatives nor any connection to Western European gas networks. The only outside connection is with Latvia, which can supply gas to Lithuania in case of emergency from its Inčukalns underground gas storage facility. The price of natural gas deliveries to Lithuania has been rising for many years. The increase

started in 2002, and even Gazprom’s 37.1 percent acquisition in 2004 of vertically integrated natural gas monopoly Lietuvos Dujos did not prevent the rise. From 2009 to 2014, Gazprom charged Lithuania 9.5 percent more for gas than it did Germany, which is several thousand kilometers farther from Russia than Lithuania is. Lithuania’s role as a reliable transit country — Gazprom’s gas is delivered to Kaliningrad district through Lithuania — did not make a positive impact, either. Lithuania suffered greatly from the unfair pricing policy of a single gas supplier, politically motivated cuts of energy supplies and blackmailing of domestic politicians, who have come under enormous pressure to leave the system as is.

Lithuania’s LNG terminal

Gazprom has applied its unfair pricing policy and abuse of its dominant position to Latvia and Estonia as well. Thus, it wasn’t surprising when the Baltic states jointly began to investigate possibilities for constructing an LNG terminal. For a long time, however, the idea of a regional LNG terminal was not realized. In July 2010, the Lithuanian government decided that state-owned oil company Klaipedos Nafta would implement the LNG terminal project alone. It was also decided that the LNG terminal would be a flexible floating storage regasification unit (FSRU). In June 2011, the FSRU was ordered from Hyundai Heavy Industries in South Korea and later named “Independence,” indicating the goal of the LNG terminal — to become independent from a single supplier. On October 27, 2014, the FSRU docked in Klaipėda port and a few days later underwent testing. Since the end of December 2014, Independence has operated commercially, supplying Lithuanian consumers and also selling gas to Estonia.

Supply of LNG to the Klaipėda terminal became possible in August 2014 when Lithuania’s state gas company, LITGAS, signed a five-year contract with Norway’s Statoil for a minimum volume of 0.54 bcm of natural gas annually. For the first time in the history of the region’s gas market, the gas price was linked not to the oil price index, but to the National Balancing Point (NBP), Great Britain’s natural gas exchange index. The exact price formula is not disclosed, but it is flexible, and in addition to the NBP index, it involves sales margins by Statoil, transportation costs and various tariffs.

Delivered LNG is more expensive than pipeline gas, but from a financial standpoint the project has been successful from the beginning. Clear proof that it was changing pricing policy came when Gazprom “surprisingly” agreed to cut its price 20 percent immediately after it became clear that the LNG terminal would stay open. There is no doubt that other factors, such as legal disputes with Gazprom, also played a role, but the importance of the terminal should not be underestimated. Lithuanian consumers pay 108 million euros for the terminal annually, but they now pay much less for natural gas. In fact, this would be true even if natural gas were not supplied via the new LNG terminal — the discount on Gazprom’s gas has already compensated for a considerable portion of the project’s costs. It is important to note that opening market relations allowed for the creation of a regional gas market that would further increase transparency in the gas industry, lower the price and help to establish related business activities such as bunkering and storage.

It is noteworthy that the regasification capacity of the FSRU in Klaipėda is 4 bcm per year. Natural gas consumption in Lithuania is only 2.3 bcm annually. Therefore, the LNG terminal can not only satisfy Lithuania’s needs, but also up to 90 percent of the natural gas needs in all three Baltic states. And the development of related businesses, such as establishing a hub for ship fueling and conducting bunkering activities, are already being discussed. In other words, the LNG terminal could supply fuel for ships visiting Klaipėda port and/or fill smaller LNG transport vessels that would supply LNG to other eastern Baltic ports such as Ventspils and Riga, and those in Estonia and Poland. LNG could be distributed regionally using road transportation as well. Bunkering and similar activities are expected to increase utilization of the terminal by 10 percent and reduce maintenance costs for Lithuanian consumers.

One of the preconditions for the LNG terminal to function was guaranteed access to the gas transmission and distribution network, i.e., pipelines. Since the Lithuanian gas sector was vertically integrated — Gazprom was not only the supplier of gas, but also controlled the pipelines — energy sector reform was required. Therefore, the Lithuanian Parliament adopted a law on natural gas, based on the EU Third Energy Package’s principles and requirements, that led in 2013 to the partition of vertically integrated natural gas monopoly Lietuvos Dujos into three separate companies: Lietuvos Dujos, Lietuvos Duju Tiekimas and AmberGrid. Lietuvos Duju Tiekimas was allowed to supply gas to individual consumers; Lietuvos Dujos manages the local pipeline network; AmberGrid became a transmission system operator that implements strategic projects and manages main pipelines. Before this reform, the state bought back shares from E.ON, a German energy company, and later from Gazprom, putting the major gas company, then Lietuvos Dujos, back under state control. Unbundling was needed because the LNG terminal could not have become operational if the company controlling the pipelines could refuse pipeline access to gas from the LNG terminal.

The LNG terminal is only the first step in creating a regional gas market for Lithuania and the Baltic states. The Baltic Energy Market Interconnection Plan (BEMIP) anticipates the establishment of an open and integrated regional energy market in the natural gas sector that is also integrated into the EU internal energy market. In this regard, BEMIP foresees several key projects that would allow the Klaipėda LNG terminal to become regionally important. The first is enhancing the capacity of the Klaipėda-Kiemenai pipeline from Klaipėda to the Latvian border, which is essential for the second project, the enhancement of the Latvia-Lithuania gas interconnection. Expanding bidirectional interconnection capacity would increase cross-border trade and usage of the underground gas storage (UGS) facility in Inčukalns. The third project is modernization and expansion of Inčukalns UGS. Finally, modernizing the bidirectional Estonian-Latvian interconnection would ensure the flow of gas south-north and north-south — essential to ensure natural gas supplies for all the Baltic states without using Russian infrastructure. Construction of the gas interconnections between Lithuania and Poland, the GIPL, and between Estonia and Finland, the Balticonnector, contributes to this vision of a regional gas market.

In October 2013, the European Commission adopted a list of 248 key energy infrastructure projects called projects of common interest (PCIs). Baltic gas interconnections were labeled as PCIs, which means they can expect financial support for their development and accelerated implementation. In November 2014, the list of PCIs to receive financial assistance under the Connecting Europe Facility instrument was presented with the next call for financing applications expected in 2015. The Klaipėda-Kiemenai gas pipeline was placed on this list as a project that will receive the maximum financial assistance of 27.6 million euros for construction.

Once construction is completed, the next important step is to agree on the rules for the regional gas market. Even without clear trading rules, LITGAS, which trades LNG from the terminal, was able to sign agreements with two Estonian energy companies, Eesti Energia and Reola Gaas, to supply natural gas. Closer cooperation between the Baltic states and Finland should lead to the establishment of a joint natural gas exchange that would continue downward pressure on gas prices and increased energy security. To achieve this, the governments of the Baltic states and Finland have started negotiating laws and regulations that promote market rules in the region. This will make natural gas markets in the region transparent and allow for the formation of objective prices — benefiting consumers and most competitive suppliers.

Conclusions

The gas supply crisis motivated Europe and changed the way citizens, companies and governments inside the EU think. The crisis boosted cooperation and accelerated EU reforms. However, to implement concrete strategic projects, states must demonstrate political will and have the courage to take associated risks.

With other LNG terminals in the region still in the planning stage — indicating serious obstacles — the LNG terminal in Klaipėda has potential regional importance. But to reach fulfillment, it is essential that Latvia implement the EU Third Energy Package. Without it, there would be no possibility of supplying natural gas to Latvian pipelines and using the Inčukalns UGS. The liberalization of the Latvian natural gas market is expected in 2017.

The Lithuanian LNG terminal was developed to reduce dependency. It aims to benefit from cooperation with Gazprom and from new relationships with Statoil and other players on the LNG market. Benefits of pipeline-gas diversification are already there: less room for political pressure and better market relations lead to lower prices and more flexible contracts. Consumers gain power and become stronger in negotiations.

After completing “hard” projects such as terminals and interconnections, the Baltic states should discuss mechanisms and rules of “soft” cooperation that should lead to the creation of a common regional gas market. A functioning market is the shortest way to transform overdependence into interdependence without confrontation.

Comments are closed.